Private investors in developed countries often overlook the benefits of investing in other currencies and foreign interest rates, more specifically we can distinguish:

- Currency trading: The act of exchanging one currency for another with the expectation that the purchased currency provides a better store of value;

-

Carry strategy: The act of capitalizing on the spread between a foreign and domestic interest rate.

These two strategies are often used in conjunction. This all might not seem very clear and concrete so we will provide a simplified example/case of a real executed strategy to show their benefits and how we can incorporate mathematical models and expert judgement in our strategy.

We make use of a EUR-PLN currency and carry investment strategy. In this strategy we convert EUR to PLN (Polish currency), put it one year in a Polish savings account and convert it back to EUR at the end of this investment period. As this strategy was executed in the past, we can see how it performed but also why it was deemed to be appealing.

We assume and use the following simplified numbers and rates:

-

At t=0 (corresponding with 1 March 2023) we make an investment, the amount is not relevant as we look at relative returns. The investment is in EUR and converted to PLN;

-

We make a simplistic but justified assumption for the (average) spread of 4% over the course of the next year;

-

An (observed) exchange rate of 4.70 EUR/PLN is used for 1 March 2023;

-

An (observed) exchange rate of 4.32 EUR/PLN is used for 29 February 2024;

-

At t=1 (corresponding with 29 February 2024) the resulting amount is converted back to EUR.

This strategy in hindsight results in a relative yield of 13.1% (= 1.04 * (4.70/4.32)) over the course of a year. So please note that this is not the absolute yield as it considers the spread relative to a EUR savings rate.

That is great and such a strategy seems like a no-brainer in hindsight but this type of strategy exposes one to currency exchange risk and interest rate spread risk. To assess these risks we however would need to develop some models and embed beliefs and anticipated impacts.

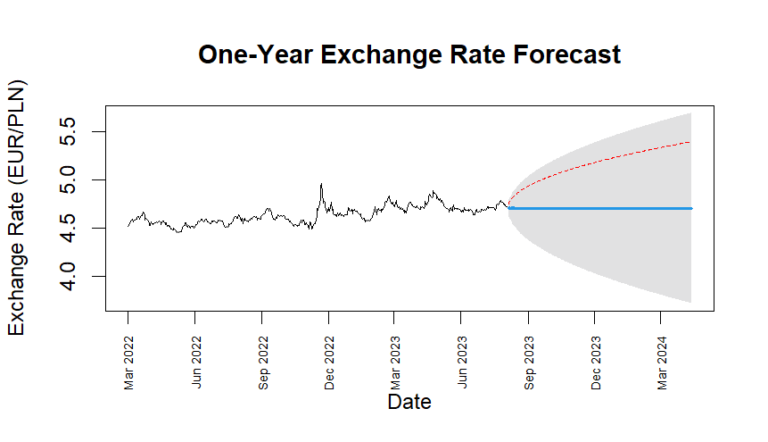

To showcase a possible approach, we could build and employ a time series model to examine the likelihood of various outcomes. If we employ a simple model, of which the outcomes can be see below, we can conclude that the movement in currency rate is not very likely (<30% according to simple model plotted below) to offset the anticipated interest rate spread of 4% over the course of a year. A loss of over 7% needs to be anticipated in the 95th percentile in the scenario analysis however (red line in plot below).

So based on this simple analysis this strategy seems appealing for an investor that is not too risk-averse. This is even more the case if we would include some other considerations:

-

Poland being in an important election year in 2023, which can result in considerable strengthening in the currency due to market preferences;

-

Indicators in the EUR monetary zone showing disappointing economical developments which can put pressure on the currency;

-

The ECB increasing the (EUR) interest rate very gradually, which reduces the risk of a quick narrowing of the considered interest rate spread.

So this all shows that successful strategies can be made based already on simple but adequate approaches. Note however that the presented approach is overly simple and we employ much more rigorous approaches in practice, which also take the risk tolerance of the investor into consideration.

Do you want to know where the possibilities are for the upcoming year and how you can benefit, please contact us to discuss these.